Create A Small Steps Savings Plan

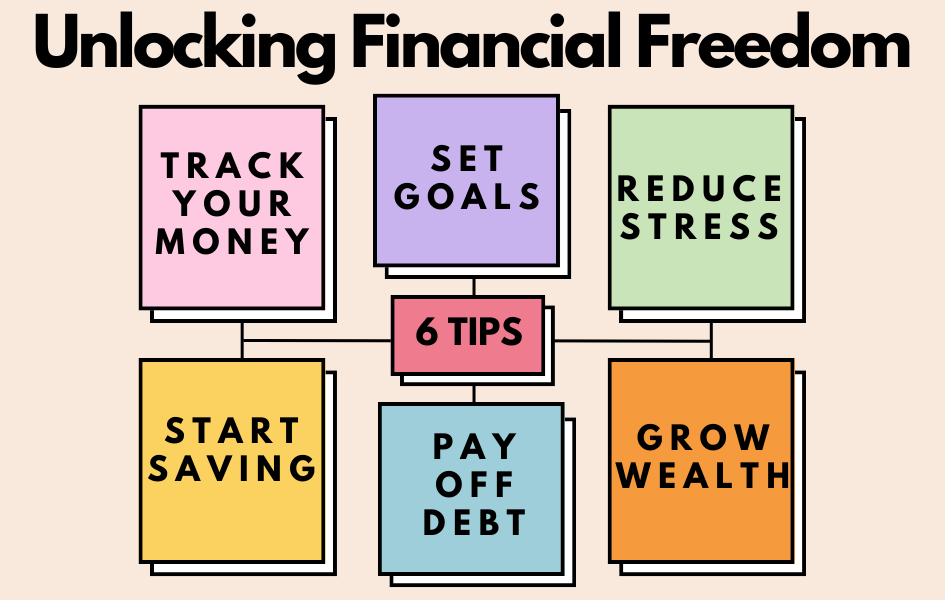

Creating a small steps savings plan can be an effective way to achieve your financial goals without feeling overwhelmed or discouraged. Here are some steps you can take to create a savings plan that works for you:

1. Define your financial goals

The first step in creating a savings plan is to define your financial goals. This could be anything from saving for a down payment on a house, to building an emergency fund, to investing for retirement. Once you’ve identified your goals, determine how much you need to save and by when.

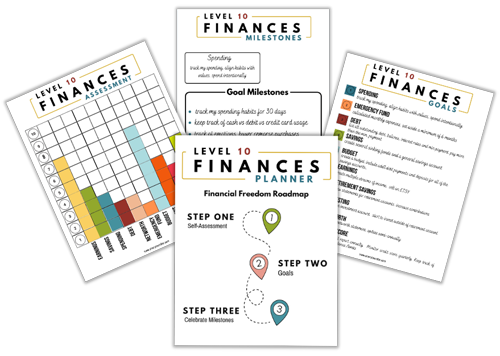

Here are some tips on how to use The Spending Diary to meet your financial goals, align your spending with your values; and help change your money mindset and money story.

2. Break down your financial goals into smaller, achievable goals

Next, break down your financial goals into smaller, more manageable goals that you can work towards over time. For example, if your goal is to save $10,000 for a trip to Europe, you might aim to save $416.67 per month. This can be less overwhelming than focusing on meeting your $10,000 target amount.

3. Create a Budget

Creating a budget is a crucial step in any savings plan. Calculate your monthly income and expenses and identify areas where you can cut back to free up more money for savings. This might involve reducing spending, negotiating bills, or finding ways to increase your income.

4. Automate Your Savings

One of the most effective ways to save money is to include it as part of your budget. Pay yourself first. Set up automatic transfers from your checking account to a savings account. This will ensure that you’re consistently setting money aside towards your financial goals, even if you don’t have the time to do so manually.

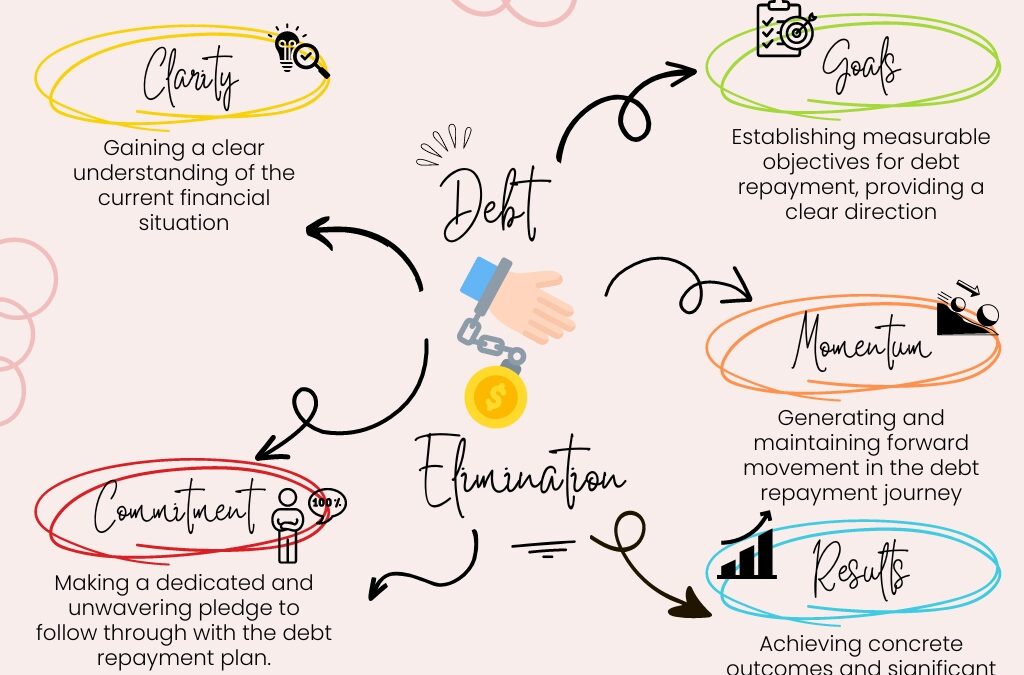

5. Prioritize debt repayment

If you have outstanding debts, it’s important to create a repayment plan – prioritizing repayment. This might involve focusing on higher-interest debt first and/or consolidating multiple debts into a single payment to make the payment more manageable. By reducing your debt burden, you’ll be more motivated to save and you should have more money available for savings.

Stay on track

Share your financial goals with a friend and/or family member that you trust. This may provide some accountability and support. In addition, sharing your money goals can help you stay motivated and on track with your savings plan.

Summary

In conclusion, creating a small steps savings plan can be an effective way to achieve your financial goals. By defining your goals, breaking them down into smaller, achievable steps, creating a budget, automating your savings, prioritizing debt repayment, and seeking accountability and support, you can build momentum and achieve success over time. Remember, even small steps can lead to big results.

Check out some of my small steps savings plans. Start from where you are now. But, it’s important to get started!

Sherry Lou

DISCLOSURE: THIS POST MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS, AT NO COST TO YOU.

Journaling Tips – How to Start Journaling for Self-Discovery

Journaling Tips How to start journaling for self-discovery Journaling isn’t just about writing—it’s about figuring out who you really are. It’s your space to get real, let go of the noise, and connect with what actually matters to you. Ever feel stuck, lost, or like...

The Journey of Little Moments

The Journey to Little Moments Journal How the Journey of Little Moments Journal Helps You Embrace Authenticity and Self-Discovery Hey there, friend! Let me ask you a question: when you think back on your life, what do you want to remember? The big,...

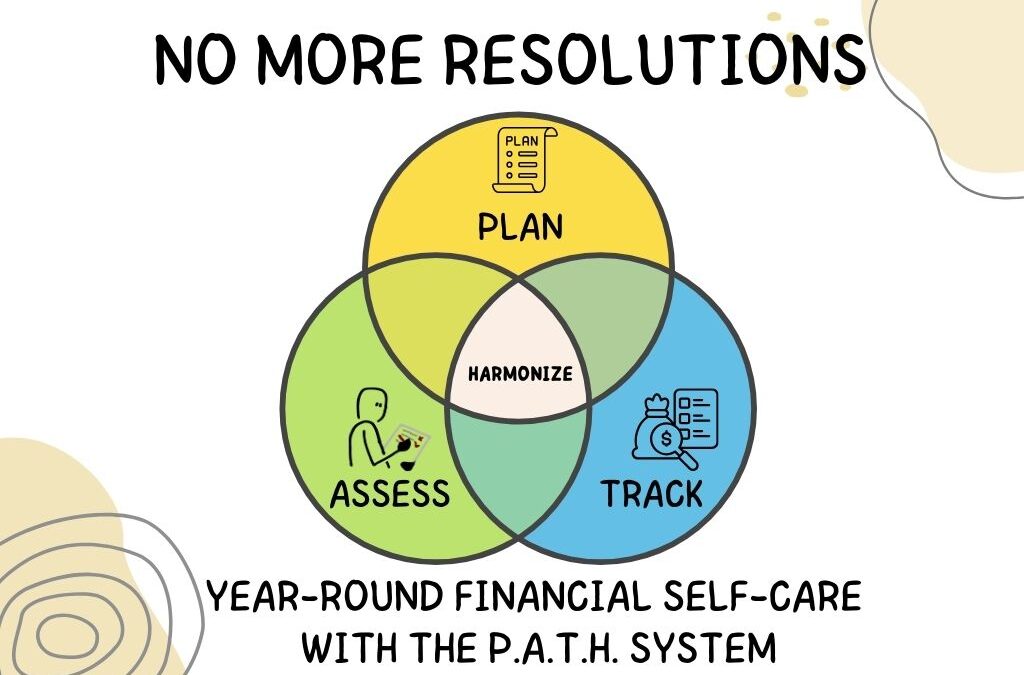

No More Resolutions

No More Resolutions: Make Lasting Changes to Your Money Embrace Financial Self-Care All Year Long: Get Clarity - Be Intentional. Introduction Every year, we set those big, bold New Year’s resolutions—promises to ourselves that we’ll make this the year...

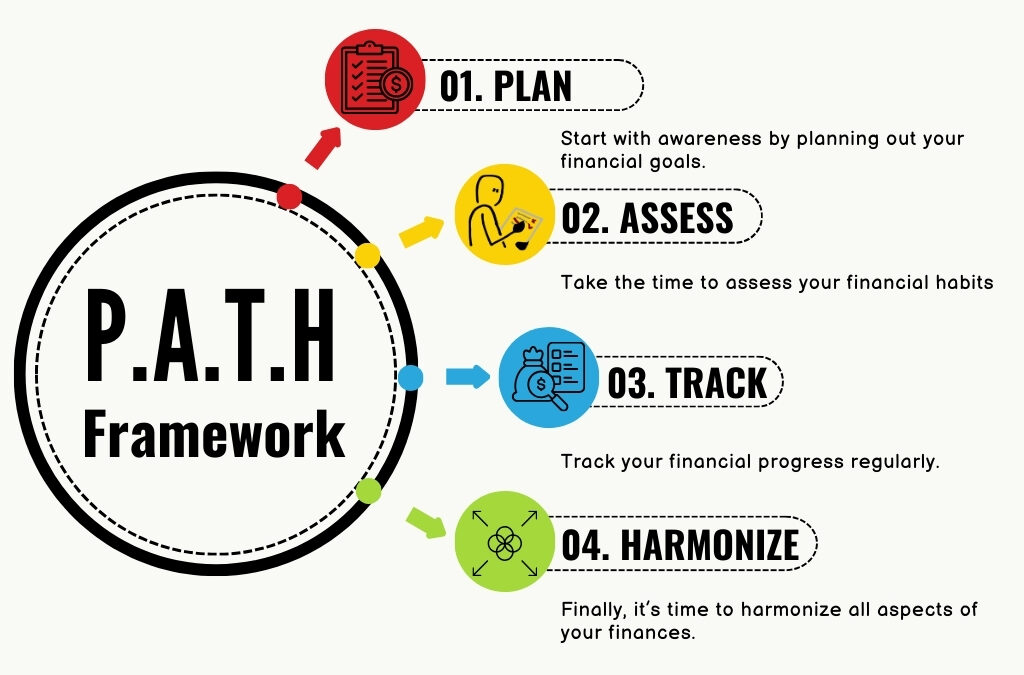

Discover the P.A.T.H. to Financial Success

Discover the P.A.T.H. to Financial Success Unlock the steps to take control of your money and achieve your financial goals. Introducing the P.A.T.H. Framework: Your Step-by-Step Guide to Financial Success Hey there! Are you tired of feeling overwhelmed...

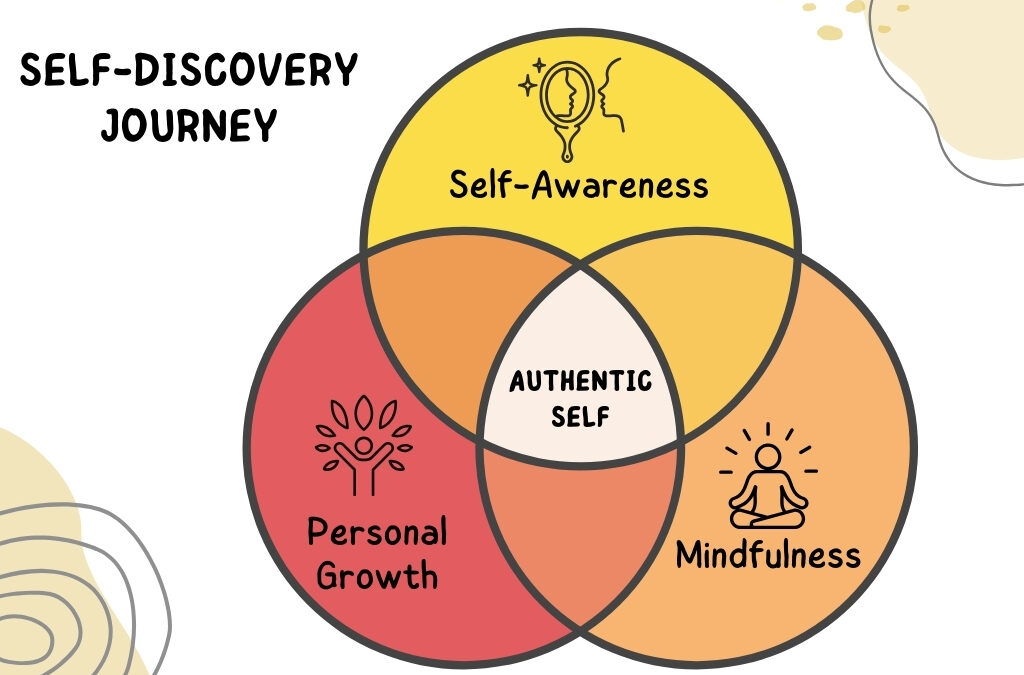

Self-Discovery Journey

Embracing My Year of Self-Discovery: A Journey to Authenticity It’s Scorpio season, and as my birthday approaches, I always take this time to reflect on the past year. I don’t use January 1st as my new year’s starting point – I use my birthday to set the tone for...

A Journey to Abundance and Beyond

Unlock Abundance with the 30-Day Abundance Journal Are you ready to shift your relationship with money and invite more abundance into your life? The journey to financial freedom begins with a mindset rooted in abundance, and I have just the tool to guide you along the...

The Power of the Debt Snowball Method

Unlocking Financial Freedom: The Power of the Debt Snowball Method Facing Financial Challenges In today's fast-paced world, many people, especially beginner budgeters, find themselves facing overwhelming debt and financial stress. The constant struggle...

21 Day Unlock Abundance Experience: Transform Your Mindset

Transforming Your Mindset Transforming your money mindset starts with small changes. In a world where money is often associated with stress and scarcity, cultivating a healthy money mindset can be a game-changer. The 21 Day Unlock Abundance Experience is a powerful...

Mindful Money Management

Mindful Money Management A concept that involves being conscious, intentional, and aware of how we handle our finances. It goes beyond traditional budgeting methods and tracking expenses; it encompasses a holistic approach to money that considers our values, goals,...

A Budget Is A Powerful Tool

A Budget Is A Powerfult Tool Our Budget Tracker is a powerful tool designed to help you effortlessly track the inflow and outflow of your money. Unlocking Financial Freedom: Small Steps Budget Kit Are you ready to embark on a journey towards financial...