Mindful Money Management

A concept that involves being conscious, intentional, and aware of how we handle our finances. It goes beyond traditional budgeting methods and tracking expenses; it encompasses a holistic approach to money that considers our values, goals, and emotional relationship with money.

Key elements of mindful money management include:

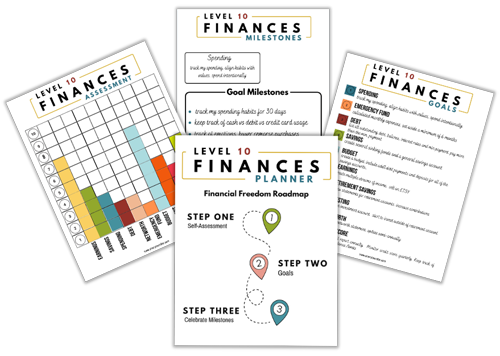

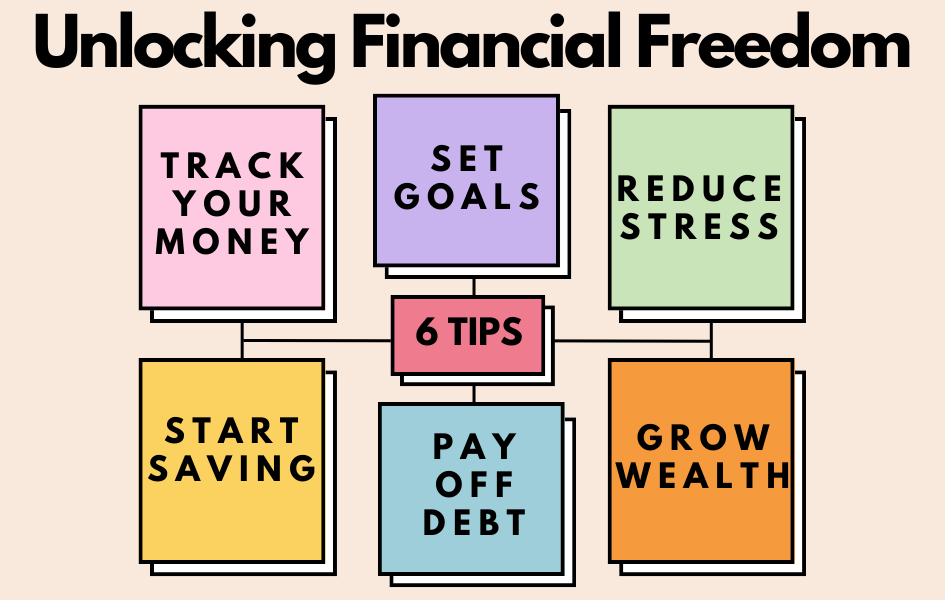

Are you ready to embark on a journey towards financial stability and wealth? Our Small Steps Budget Kit is here to empower you on your path to financial freedom.

Today, I will explore why a budget is a powerful tool to take control of your finances, as well as six ways a budget can help you build financial stability and create wealth.

1. Financial Awareness:

Mindful money management begins with developing a clear understanding of your financial situation. This includes knowing your income, expenses, debts, and savings.

Becoming aware of your finances helps you to make informed financial choices and identify areas where you can make adjustments.

2. Budget with Intention

Creating a budget is an essential component of mindful money management. However, it’s not just about limiting spending or being frugal.

It’s about allocating your resources in alignment with your values and financial goals.

A conscious spending plan focuses on funding what brings you joy and fulfillment while reducing spending on things that don’t contribute to your well-being.

3. Conscious Spending

Mindful money management encourages intentional spending.

Before you make a purchase, take a moment, a day or a week to determine whether or not this purchase and/or experience is aligned with your values and/or goals.

Avoid impulse buying. Focus on what truly matters to you.

4. Emotional Awareness

Our emotions can significantly impact our financial choices.

Mindful money management involves making yourself aware of your emotions (stress, jealousy, impulsivity, fear) and the impact these emotions have on your spending behavior.

5. Mindset Shift

Embracing an abundance mindset rather than a scarcity mindset is key to living intentionally.

This shift in perspective will help you focus on gratitude for what you already have – appreciating the present moment.

6. Aligning Money with Values

Mindful money management encourages you to align your financial choices with your core values by spending in ways that reflects what matters to you.

Summary

Remember, developing a conscious spending plan is about creating a mindful/intentional relationship with your money.

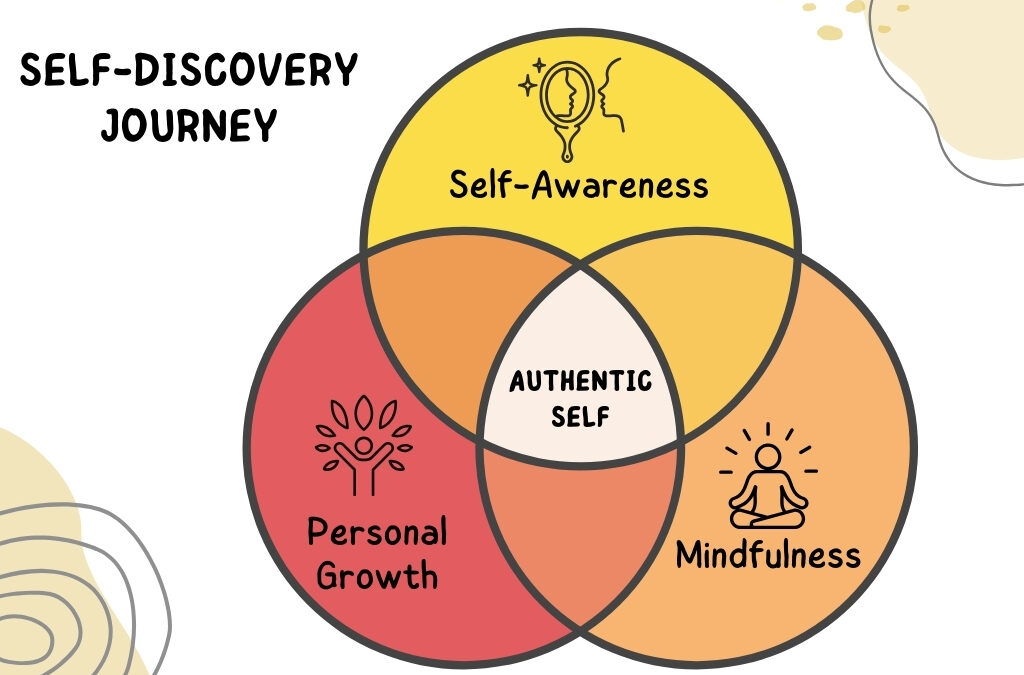

It’s a journey of self-awareness, aligning your spending habits with your financial goals and values.

It’s about making conscious spending choices that support your overall well-being.

If you want to achieve greater financial success, sign-up for The Conscious Spending Roadmap Mini-Course today!

Sherry Lou

DISCLOSURE: THIS POST MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS, AT NO COST TO YOU.

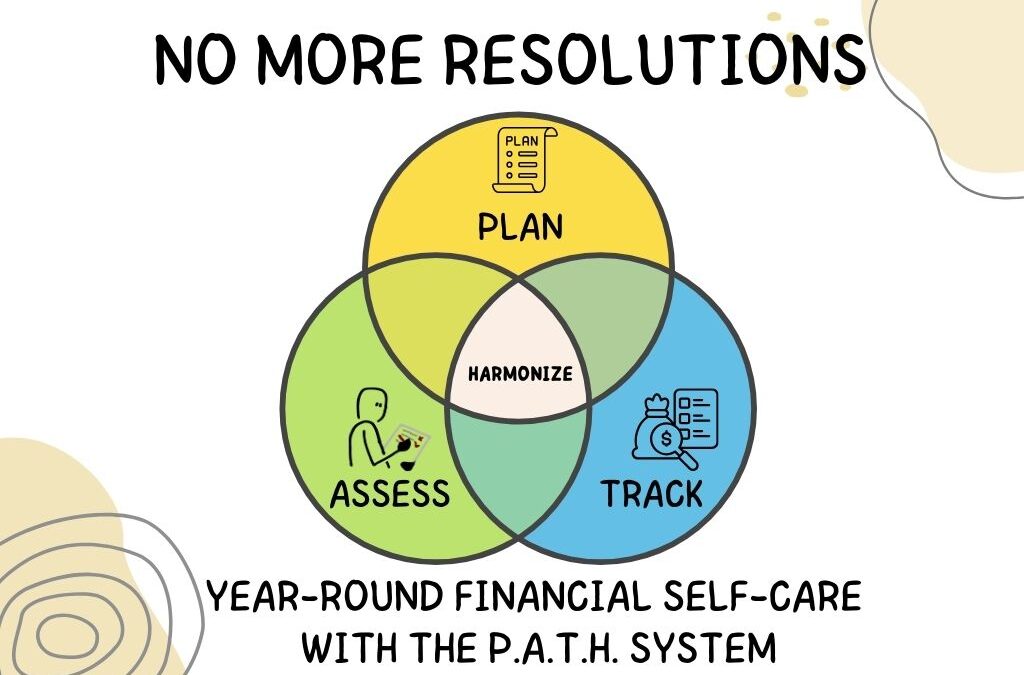

No More Resolutions

No More Resolutions: Make Lasting Changes to Your Money Embrace Financial Self-Care All Year Long: Get Clarity - Be Intentional. Introduction Every year, we set those big, bold New Year’s resolutions—promises to ourselves that we’ll make this the year...

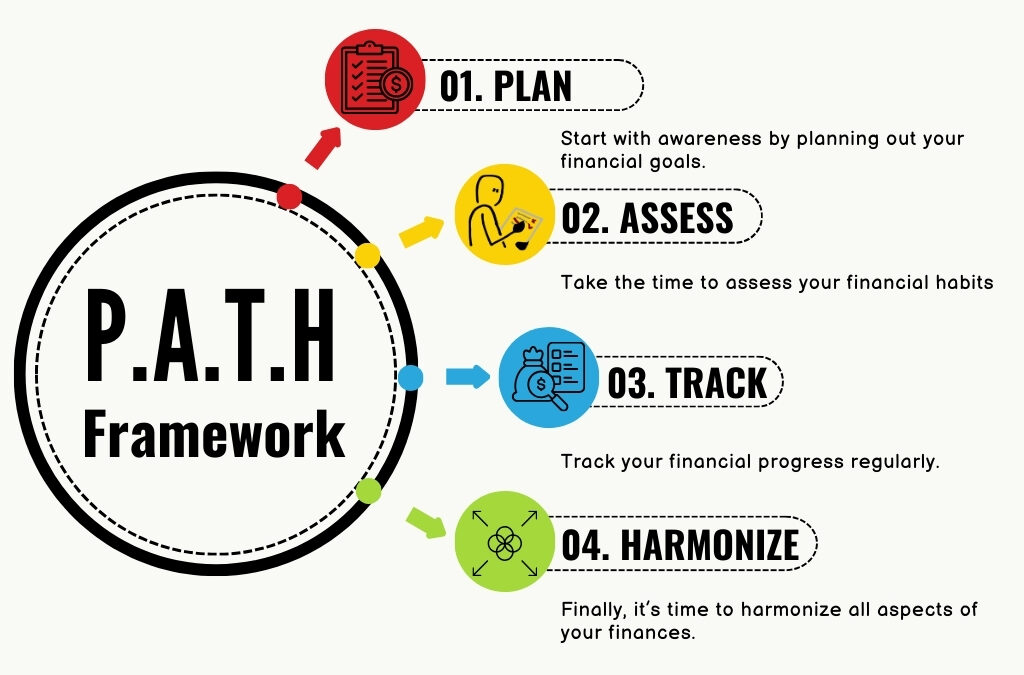

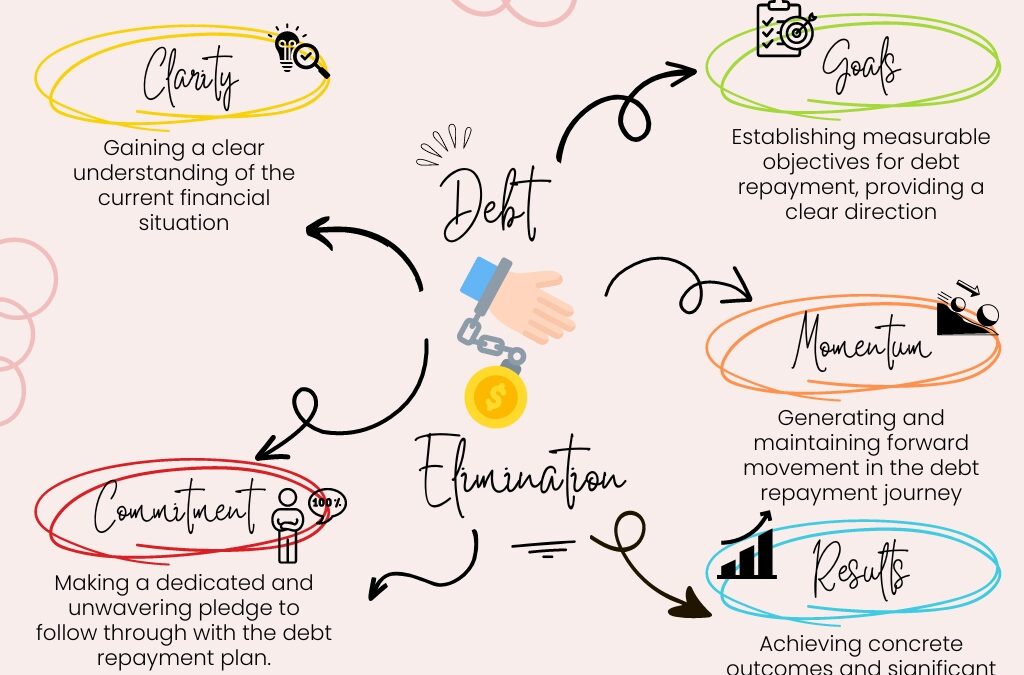

Discover the P.A.T.H. to Financial Success

Discover the P.A.T.H. to Financial Success Unlock the steps to take control of your money and achieve your financial goals. Introducing the P.A.T.H. Framework: Your Step-by-Step Guide to Financial Success Hey there! Are you tired of feeling overwhelmed...

Self-Discovery Journey

Embracing My Year of Self-Discovery: A Journey to Authenticity It’s Scorpio season, and as my birthday approaches, I always take this time to reflect on the past year. I don’t use January 1st as my new year’s starting point – I use my birthday to set the tone for...

A Journey to Abundance and Beyond

Unlock Abundance with the 30-Day Abundance Journal Are you ready to shift your relationship with money and invite more abundance into your life? The journey to financial freedom begins with a mindset rooted in abundance, and I have just the tool to guide you along the...

The Power of the Debt Snowball Method

Unlocking Financial Freedom: The Power of the Debt Snowball Method Facing Financial Challenges In today's fast-paced world, many people, especially beginner budgeters, find themselves facing overwhelming debt and financial stress. The constant struggle...

21 Day Unlock Abundance Experience: Transform Your Mindset

Transforming Your Mindset Transforming your money mindset starts with small changes. In a world where money is often associated with stress and scarcity, cultivating a healthy money mindset can be a game-changer. The 21 Day Unlock Abundance Experience is a powerful...

A Budget Is A Powerful Tool

A Budget Is A Powerfult Tool Our Budget Tracker is a powerful tool designed to help you effortlessly track the inflow and outflow of your money. Unlocking Financial Freedom: Small Steps Budget Kit Are you ready to embark on a journey towards financial...

How to Create a Small Steps Savings Plan

Create A Small Steps Savings Plan Creating a small steps savings plan can be an effective way to achieve your financial goals without feeling overwhelmed or discouraged. Here are some steps you can take to create a savings plan that works for you: 1. Define...

Track Your Spending

Track Your Spending Habits Money is and will always be an essential part of our life. Sometimes it may feel overwhelming to manage your money; but one way you can change your money mindset is by tracking your spending habits. Keep a Spending Diary Keeping a spending...

Selling On ETSY – How I Eventually Found Success Selling Digital Products

My Entrepreneurial Journey – How I Eventually Found Success Selling On ETSY My Entrepreneurial Journey hasn’t been a straight line but I’ve finally found success selling on ETSY MY STORY Using ETSY,...