My journey to becoming financially fit

Most of my adult life I was not financially fit. My finances were so “out of shape”. I had been plagued by high interest rate loans because of my low credit scores. And, those low credit scores were costing me more money over the long-term. So, a few months ago, I made the decision to become financially fit. The first step to in that process was to figure out my current state of affairs. What is my credit score? How much debt do I have? What type of debt do I have? What’s the interest rate for each creditor?

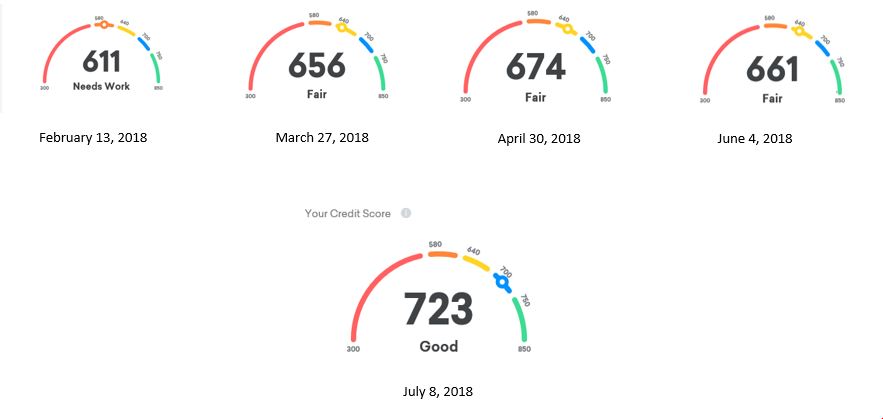

Last November I purchased a new car, so I know that my credit score was approximately 660, which for me was pretty good. And then, one day I received an email that my credit score had changed. I logged into Credit Karma and saw 611. What the ???? My score dropped 50 points in a few months. Needless to say, I wasn’t pleased. I reviewed my history and realized my credit usage was extremely high. During the months of November, December and January, I used my credit cards to invest in several online courses. I wasn’t thinking about the impact on my credit score. Although I wasn’t devastated, I was disappointed.

Over the next couple of months, I worked to pay down the balances for a few credit cards with the hope of raising my credit score a few points. This strategy worked in my favor. You know that feeling you get when you step on the scale and you’ve lost a few pounds? That’s how I felt. I was on my way to becoming financially fit.

Once I got my credit score back up to 660, I decided to consolidate the debt. Let me rephrase that, I decided to research the benefits of consolidating my credit card debt.

Researching debt consolidation:

-

- I compiled a list of ALL of my debt (credit cards, student loan, car loan, personal loan).

- Created a spreadsheet listing each creditor, balance, minimum payment and interest rate.

- Searched google for a snowball debt calculator.

- Updated the calculator with the information from step #2.

- Reviewed the output which was based on my current monthly payments

- how long would it take me to repay all of my debt?

- how much interest would I pay?

- if i paid an additional $50, $75 or $100 per month, what would be the impact on the repayment period and total interest paid?

I completed LendingClub’s online loan application.

I reviewed my options. Length of the loan (36 months, 48 months or 60 months), interest rates and total interest payments for each.

- I made a list of pro’s and con’s

Pros:

- Raise my credit score

- One monthly payment

- The length of the loan was fixed. (i.e. if you have credit card debt, you understand what I mean. If you’re paying the minimum payments each month, it could take years to repay the balance. And that $30 dinner, would have cost 2 maybe 3 times that amount).

Cons:

- Basically, I was just reassigning the debt. Total outstanding debt was unchanged.

- Slight hit on my credit score for new loan/credit inquiry.

After careful consideration, I determined a debt consolidation loan was the best course of action for me.

A few years ago, I relocated across the country. I didn’t have enough savings to finance the move, so I took out a loan with LendingClub. I repaid the loan before it was due and I didn’t have any issues with the company.

Based on that experience, I decided to use LendingClub to move forward with my debt consolidation loan; and, I don’t have any regrets. It’s my intention to pay more than the required monthly payment. As a result, I will pay less interest over the life of the loan AND I improved my overall credit score. If you’re interested in using the same technique, check out LendingClub.

For some of you, the snowball debt strategy might be a better option. Everyone’s situation is unique. What worked for me, may not work for you. Do your research. Create a list of pro’s and con’s. Make a comparison chart. Once you’ve collected all of your data, make a decision that best suits you and your needs.

The decision to become financially fit requires a mindset and lifestyle change, similar to the process of becoming physically fit. For me, this was my first step. The journey continues….. Referral Link – www.SherryLouMiller.com/lendingclub

I’m an affiliate for LendingClub.com. I may earn a referral fee if you sign up through my link.