How to Budget Money – Budget Spreadsheet

Money comes in, money goes out. The question is….. do you know where it’s going?

Whether the answer is yes or no, there’s probably some room for improvement.

Create a Budget

Let’s create a spending plan to improve your finances in 2021 and beyond.

Using the paycheck to paycheck budgeting template will help you evaluate your current financial health. Project your cash flow for the entire year. And, help you determine how to reach your short-term and long-term financial goals.

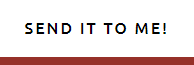

Benefits of using a Budget Template

- Track your spending.

- Identify spending habits (good and bad)

- Become intentional with your spending, savings, investing, and debt repayment.

- Avoid missed payments; thereby, avoiding late fees.

- Avoid overdraft fees.

- Reduce or eliminate monthly expenses/subscriptions.

No excuses. Make a commitment to yourself to create a budget for your money. Save money. Pay down debt. Invest money. And, of course, spend some of your money intentionally.

Now’s the time!

Create a plan to reach your financial goals.

Download the free budget template to get started.

Click the Link – Download the Budget

Spreadsheet http://bit.ly/paycheckBT

You can do it! You just have to start.

Sherry Lou

Journaling Tips – How to Start Journaling for Self-Discovery

Journaling Tips How to start journaling for self-discovery Journaling isn’t just about writing—it’s about figuring out who you really are. It’s your space to get real, let go of the noise, and connect with what actually matters to you. Ever feel stuck, lost, or like...

The Journey of Little Moments

The Journey to Little Moments Journal How the Journey of Little Moments Journal Helps You Embrace Authenticity and Self-Discovery Hey there, friend! Let me ask you a question: when you think back on your life, what do you want to remember? The big,...

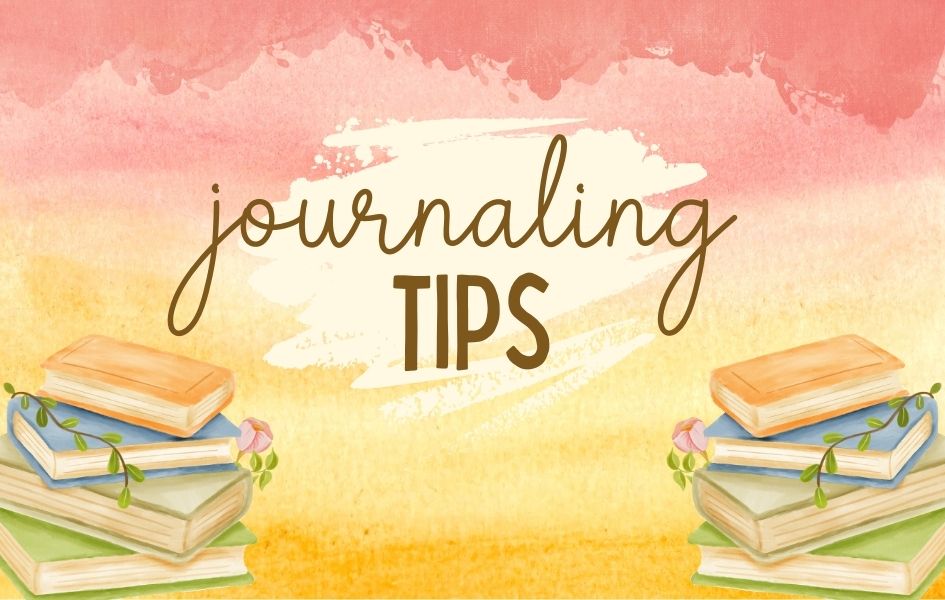

No More Resolutions

No More Resolutions: Make Lasting Changes to Your Money Embrace Financial Self-Care All Year Long: Get Clarity - Be Intentional. Introduction Every year, we set those big, bold New Year’s resolutions—promises to ourselves that we’ll make this the year...

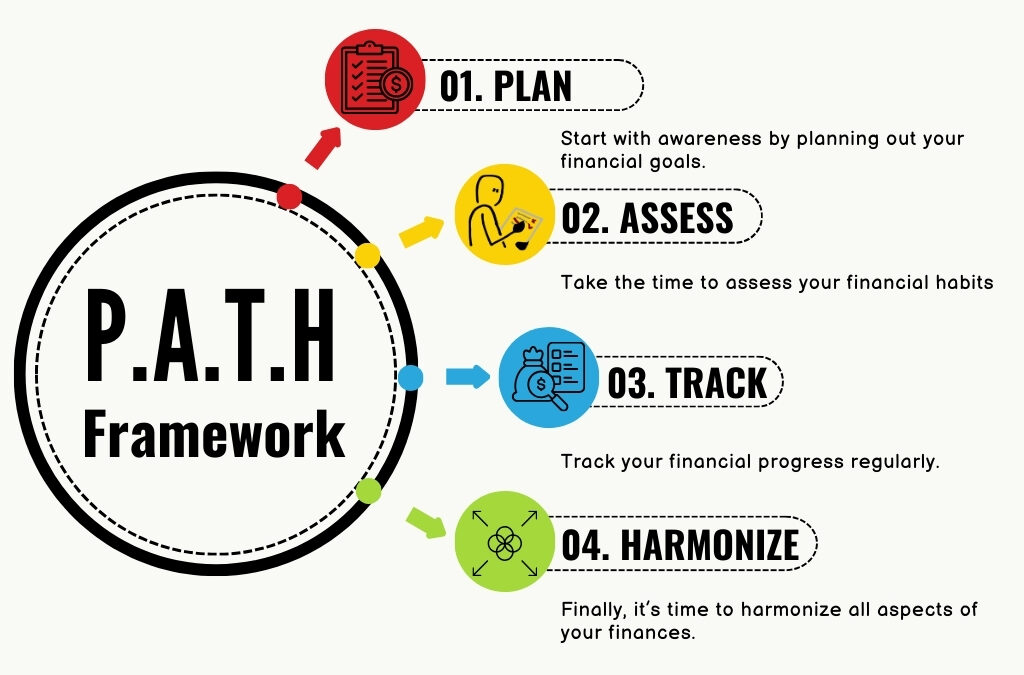

Discover the P.A.T.H. to Financial Success

Discover the P.A.T.H. to Financial Success Unlock the steps to take control of your money and achieve your financial goals. Introducing the P.A.T.H. Framework: Your Step-by-Step Guide to Financial Success Hey there! Are you tired of feeling overwhelmed...

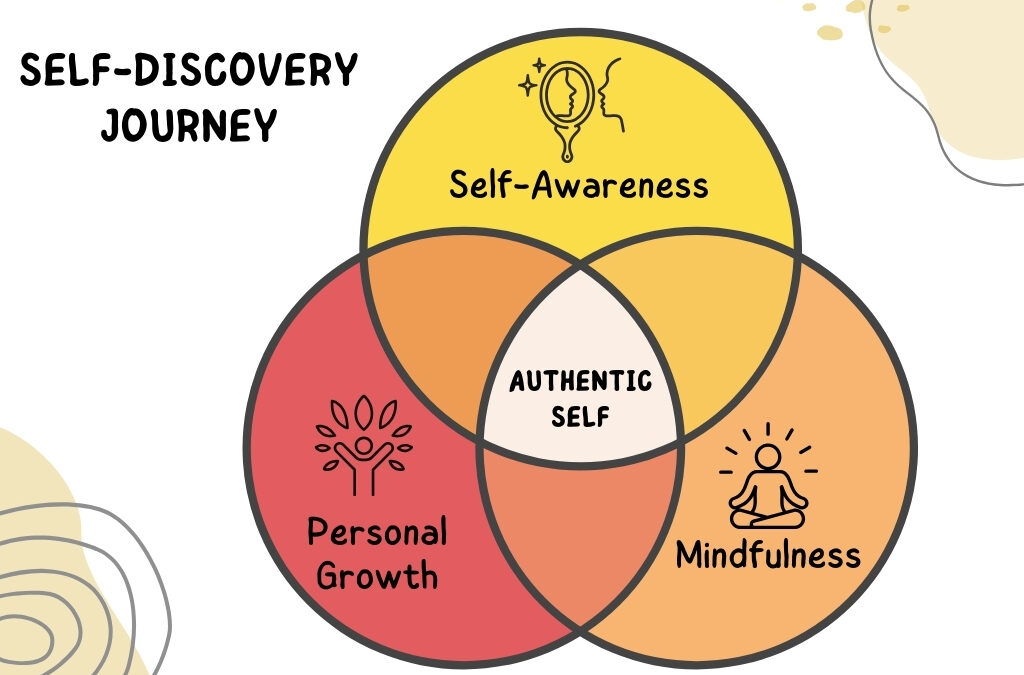

Self-Discovery Journey

Embracing My Year of Self-Discovery: A Journey to Authenticity It’s Scorpio season, and as my birthday approaches, I always take this time to reflect on the past year. I don’t use January 1st as my new year’s starting point – I use my birthday to set the tone for...

A Journey to Abundance and Beyond

Unlock Abundance with the 30-Day Abundance Journal Are you ready to shift your relationship with money and invite more abundance into your life? The journey to financial freedom begins with a mindset rooted in abundance, and I have just the tool to guide you along the...

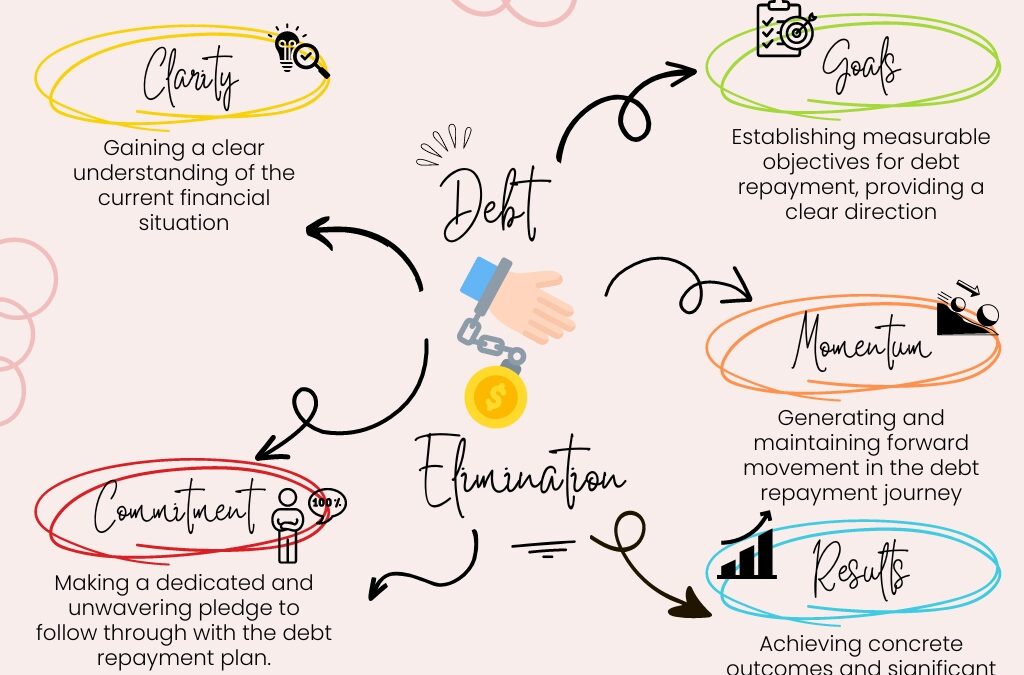

The Power of the Debt Snowball Method

Unlocking Financial Freedom: The Power of the Debt Snowball Method Facing Financial Challenges In today's fast-paced world, many people, especially beginner budgeters, find themselves facing overwhelming debt and financial stress. The constant struggle...

21 Day Unlock Abundance Experience: Transform Your Mindset

Transforming Your Mindset Transforming your money mindset starts with small changes. In a world where money is often associated with stress and scarcity, cultivating a healthy money mindset can be a game-changer. The 21 Day Unlock Abundance Experience is a powerful...

Mindful Money Management

Mindful Money Management A concept that involves being conscious, intentional, and aware of how we handle our finances. It goes beyond traditional budgeting methods and tracking expenses; it encompasses a holistic approach to money that considers our values, goals,...

A Budget Is A Powerful Tool

A Budget Is A Powerfult Tool Our Budget Tracker is a powerful tool designed to help you effortlessly track the inflow and outflow of your money. Unlocking Financial Freedom: Small Steps Budget Kit Are you ready to embark on a journey towards financial...