No More Resolutions: Make Lasting Changes to Your Money

Embrace Financial Self-Care All Year Long: Get Clarity – Be Intentional.

Introduction

Every year, we set those big, bold New Year’s resolutions—promises to ourselves that we’ll make this the year we get our finances together. But if we’re being real, those resolutions often fade away after a few weeks.

Instead of riding the rollercoaster of fleeting motivation, let’s commit to something that actually works: intentional choices, all year long.

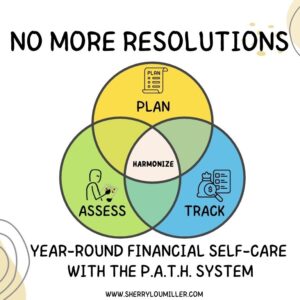

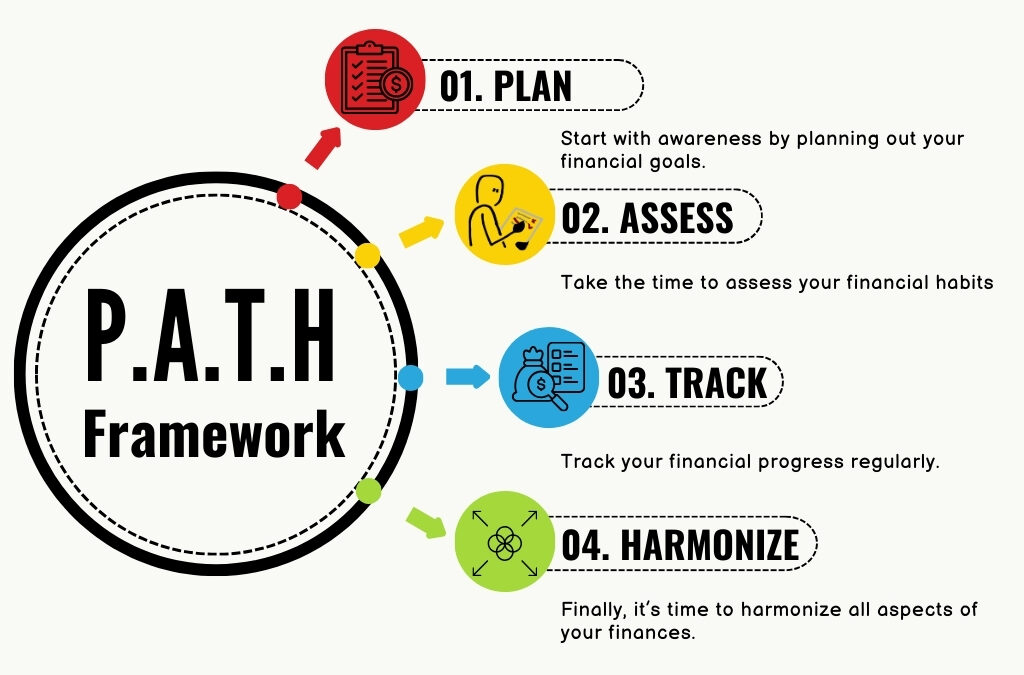

With the P.A.T.H. system, we’re talking about making real, lasting changes to how we handle our money.

P.A.T.H. stands for Plan, Assess, Track, and Harmonize—four simple but powerful steps that guide you to financial success.

No more waiting until next January to get serious about your finances. It’s about making consistent, intentional choices that align with your goals and values, every single day.

Ready to learn how to make your money work for you, no matter the time of year? Let’s dive in.

Why Intentional Choices Beats New Year’s Resolutions:

Sustainable Growth, Not Quick Fixes

Forget about setting a bunch of unrealistic goals that you won’t keep up with.

The P.A.T.H. system is all about making steady progress. It’s about building habits that stick and setting yourself up for long-term success.

Instead of waiting for the “perfect time” to get your finances together, you can start now and focus on consistent growth.

Get Real with Your Money

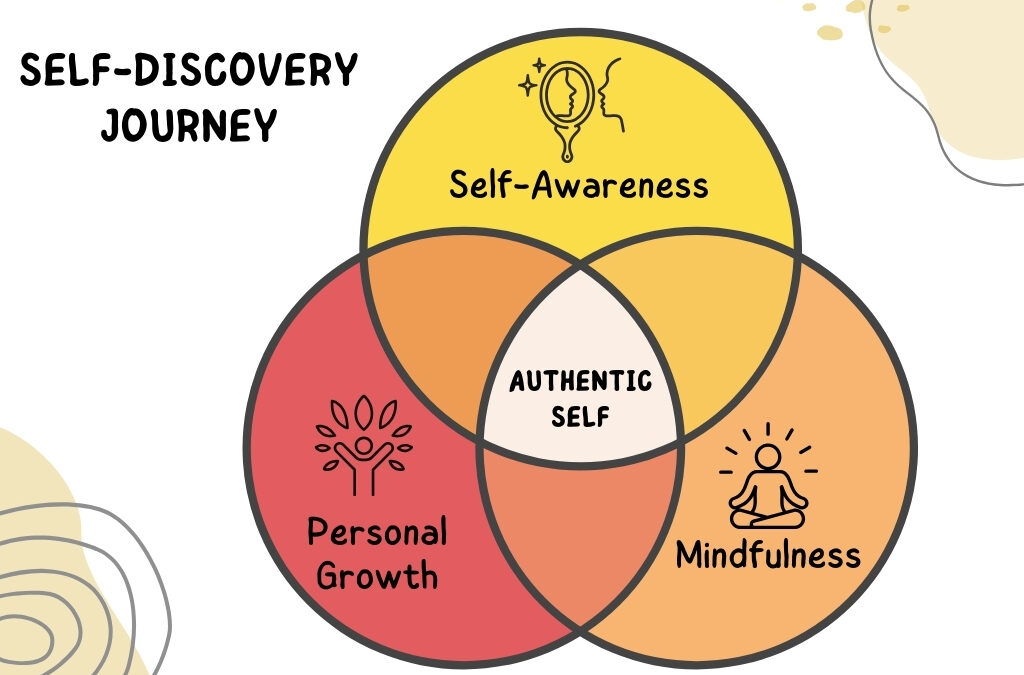

Living intentionally with your money requires self-awareness.

It’s about understanding where your money is going, what’s working, and what’s holding you back.

With P.A.T.H., you’ll check in with yourself regularly to assess how things are going and make adjustments as needed.

When you have clarity on what matters to you financially, you make smarter choices.

Be Flexible, Life Happens

We all know life can be unpredictable. With intentional choices, you’re not stuck in a rigid plan.

The P.A.T.H. system encourages you to be flexible and adapt. When things change, you adjust.

It’s not about being perfect, it’s about progress. It’s about staying aligned with your goals and making progress, even when life throws curveballs.

Take Care of the Whole You

Money isn’t everything, but it affects everything. Financial self-care is about balancing your money, your well-being, and your goals.

When you’re intentional with your finances, you create a sense of balance that stretches across all areas of your life—financial, emotional, and beyond.

How to Embrace Financial Self-Care with P.A.T.H. All Year Long:

1. Get Clear on Your Financial Priorities

Your first step is clarity. What do you want for your financial future? Whether it’s paying off debt, building an emergency fund, or saving for something special, take a moment to define what matters most to you. Once you know what you’re working toward, the path forward becomes so much clearer.

2. Set Intentions, Not Resolutions

Instead of committing to a New Year’s resolution that won’t last, focus on setting monthly or quarterly intentions.

Break down your bigger goals into smaller, more manageable actions. What’s one thing you can focus on for the next few months? Take it step-by-step, and celebrate each small win along the way.

3. Practice Mindfulness with Your Money

Mindfulness isn’t just for stress relief—it’s for your finances, too. When you’re mindful of how you spend and save, you make better decisions.

Journaling, reflecting, and using tools like an Expense Tracker and/or a Monthly Budget can help you stay present with your money choices and ensure they’re in line with your goals.

4. Get Support and Accountability

You don’t have to do this alone! Find someone you trust—whether it’s a friend, family member, or community—who can help keep you on track.

Share your goals with them and get their support. Accountability is huge when it comes to sticking to your financial plans.

Conclusion:

Let’s stop with the New Year’s resolutions and embrace intentional choices instead. With the P.A.T.H. system, you can get clarity on your financial goals, make intentional choices, and create habits that lead to lasting change.

No more chasing quick fixes. This is about real, sustainable progress in every area of your life.Ready to make 2025 the year you take control of your finances?

The Budget Bundle is the perfect tool to help you get started with the P.A.T.H. system and create the life you want.

Get Your Budget Bundle Today and start your journey toward intentional financial success!

Sherry Lou

DISCLOSURE: THIS POST MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS, AT NO COST TO YOU.

Journaling Tips – How to Start Journaling for Self-Discovery

Journaling Tips How to start journaling for self-discovery Journaling isn’t just about writing—it’s about figuring out who you really are. It’s your space to get real, let go of the noise, and connect with what actually matters to you. Ever feel stuck, lost, or like...

The Journey of Little Moments

The Journey to Little Moments Journal How the Journey of Little Moments Journal Helps You Embrace Authenticity and Self-Discovery Hey there, friend! Let me ask you a question: when you think back on your life, what do you want to remember? The big,...

Discover the P.A.T.H. to Financial Success

Discover the P.A.T.H. to Financial Success Unlock the steps to take control of your money and achieve your financial goals. Introducing the P.A.T.H. Framework: Your Step-by-Step Guide to Financial Success Hey there! Are you tired of feeling overwhelmed...

Self-Discovery Journey

Embracing My Year of Self-Discovery: A Journey to Authenticity It’s Scorpio season, and as my birthday approaches, I always take this time to reflect on the past year. I don’t use January 1st as my new year’s starting point – I use my birthday to set the tone for...

A Journey to Abundance and Beyond

Unlock Abundance with the 30-Day Abundance Journal Are you ready to shift your relationship with money and invite more abundance into your life? The journey to financial freedom begins with a mindset rooted in abundance, and I have just the tool to guide you along the...

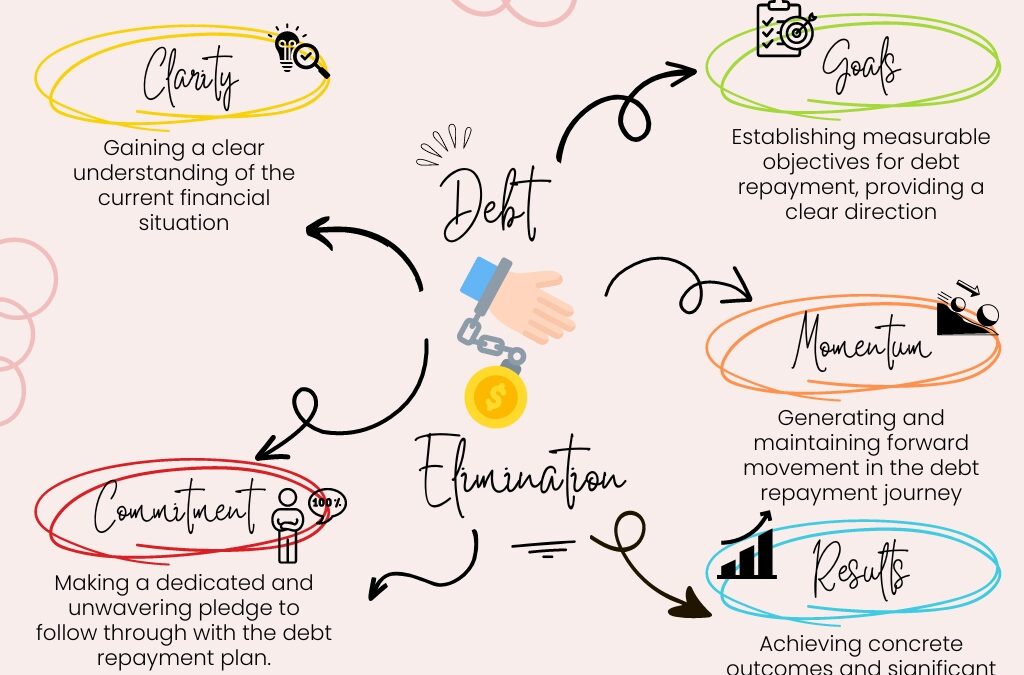

The Power of the Debt Snowball Method

Unlocking Financial Freedom: The Power of the Debt Snowball Method Facing Financial Challenges In today's fast-paced world, many people, especially beginner budgeters, find themselves facing overwhelming debt and financial stress. The constant struggle...

21 Day Unlock Abundance Experience: Transform Your Mindset

Transforming Your Mindset Transforming your money mindset starts with small changes. In a world where money is often associated with stress and scarcity, cultivating a healthy money mindset can be a game-changer. The 21 Day Unlock Abundance Experience is a powerful...

Mindful Money Management

Mindful Money Management A concept that involves being conscious, intentional, and aware of how we handle our finances. It goes beyond traditional budgeting methods and tracking expenses; it encompasses a holistic approach to money that considers our values, goals,...

A Budget Is A Powerful Tool

A Budget Is A Powerfult Tool Our Budget Tracker is a powerful tool designed to help you effortlessly track the inflow and outflow of your money. Unlocking Financial Freedom: Small Steps Budget Kit Are you ready to embark on a journey towards financial...

How to Create a Small Steps Savings Plan

Create A Small Steps Savings Plan Creating a small steps savings plan can be an effective way to achieve your financial goals without feeling overwhelmed or discouraged. Here are some steps you can take to create a savings plan that works for you: 1. Define...