A Budget Is A Powerfult Tool

Our Budget Tracker is a powerful tool designed to help you effortlessly track the inflow and outflow of your money.

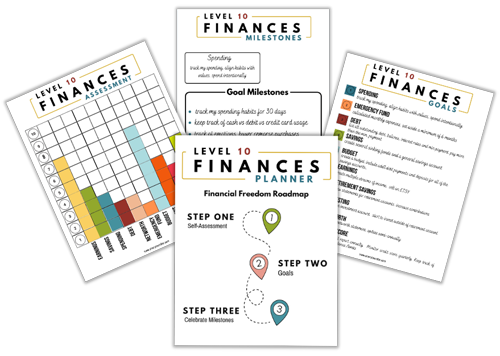

Unlocking Financial Freedom: Small Steps Budget Kit

Are you ready to embark on a journey towards financial stability and wealth? Our Small Steps Budget Kit is here to empower you on your path to financial freedom.

Today, I will explore why a budget is a powerful tool to take control of your finances, as well as six ways a budget can help you build financial stability and create wealth.

1. Track Your Money

A budget is a visual representation of the inflow and outflow of your money. By tracking your income and expenses, you gain a clear understanding of where your money is going. This knowledge empowers you to make informed choices about your spending habits.

2. Set and Achieve Financial Goals

One of the most powerful aspects of budgeting is the ability to set and achieve financial goals. Whether it’s paying off debt, saving for a down payment, or building an emergency fund, a budget helps you allocate your resources intentionally. By aligning your spending with your financial goals, you’ll be amazed at how quickly you can turn your dreams into reality.

3. Reduce Financial Stress

Financial stress can weigh heavily on our well-being. By having a solid financial plan in place, you’ll experience reduced anxiety and uncertainty around money. With a budget, you’ll have a clearer picture of your financial situation.

4. Build An Emergency Fund

Life is full of unexpected surprises, and having an emergency fund is crucial for weathering those storms. A budget helps you allocate a portion of your income towards building an emergency fund. By consistently saving, you’ll create a financial safety net that protects you from unforeseen circumstances.

5. Pay Off Debt and Achieve Financial Freedom

Debt can be a heavy burden, holding you back from achieving your financial goals. By allocating extra funds towards debt repayment, you can accelerate your journey to becoming debt-free.

6. Grow Your Wealth

Building wealth is not just about earning money but also about how you manage it. A budget helps you prioritize saving and investing. By setting aside a portion of your income for investments, you can grow your wealth over time. A budget makes sure that you’re consistently moving towards building financial freedom.

Summary

Don’t underestimate the power of a budget in transforming your financial life.

Our Small Steps Budget Kit is the key to unlocking financial freedom and building wealth.

By tracking your money, setting goals, reducing stress, building an emergency fund, paying off debt, and investing wisely, you’ll be on your way to achieving financial stability.

Remember, it’s never too late to start taking control of your finances.

Start budgeting today and watch your financial future flourish!

Take the first step towards financial empowerment – Grab a copy of our Small Steps Budget Kit today!

Sherry Lou

DISCLOSURE: THIS POST MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS, AT NO COST TO YOU.

Credit Education Tips

Credit Education Tips Today, I'm joined by Kevin Butts and he's providing some awesome credit educations tips. Throughout the video, we'll touch on various aspects of the credit scoring model. Watch in its entirety Kevin provides a general/broad overview...

Money Mindset – Mindful Spending Plan

Create Financial Flexibility with Mindful Spending Habits Today, I'm going to talk about money mindset and creating mindful spending habits. When you desire change, the first step is awareness. So, before you do anything else, you'll need to assess your...

How to Use Canva Tutorial

How to use Canva tutorial In this video, I'm going to shares some tips on how I use Canva in my digital product business. I'll share features that keep me organized, as well as, different features that I use to design my digital products. Earning Additional Income...

How to Budget Money

How to Budget Money - Budget Spreadsheet Money comes in, money goes out. The question is….. do you know where it’s going? Whether the answer is yes or no, there's probably some room for improvement. Create a Budget Let’s create a spending plan to improve your finances...

Manifesting with Scripting vs traditional Vision Board

Scripting versus Traditional Vision Boards For years, I've been writing my dreams in a journal and creating a vision board. It wasn't until recently that I discovered this journaling process is known as Scripting. What is scripting? In case you aren't familiar with...

30 Day Gratitude Challenge

Take the 30-Day Gratitude Challenge November is officially National Gratitude Month, so what better time to participate in the 30 Days of Gratitude Challenge. The purpose of this challenge is to focus each day on someone in your life for who you feel appreciation....

What’s Your Latte Factor?

The Latte Factor? Do you know yours? Recently, I was listening to Lewis Howes’ podcast - Be Financially Free and Pay Yourself First with David Bach (episode 791). After listening to this episode, I decided to purchase the book (The Latte Factor) and create a two-part...

How to Build Online Sales Funnels – One Funnel Away (OFA) Review

How to Build Online Sales Funnels – One Funnel Away (OFA) Review THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR DETAILS My introduction to One Funnel Away 30-Day Challenge… A few months ago (March 2019), I signed up for Russell Brunson’s...

Boost Your Savings in 2019

5 Simple Challenges to Boost Your Savings in 2019 Whether you are participating in a challenge to boost your savings, starting a new project and/or setting life goals, it’s important that you start with a “self-trust mindset”. You must believe in yourself and know...

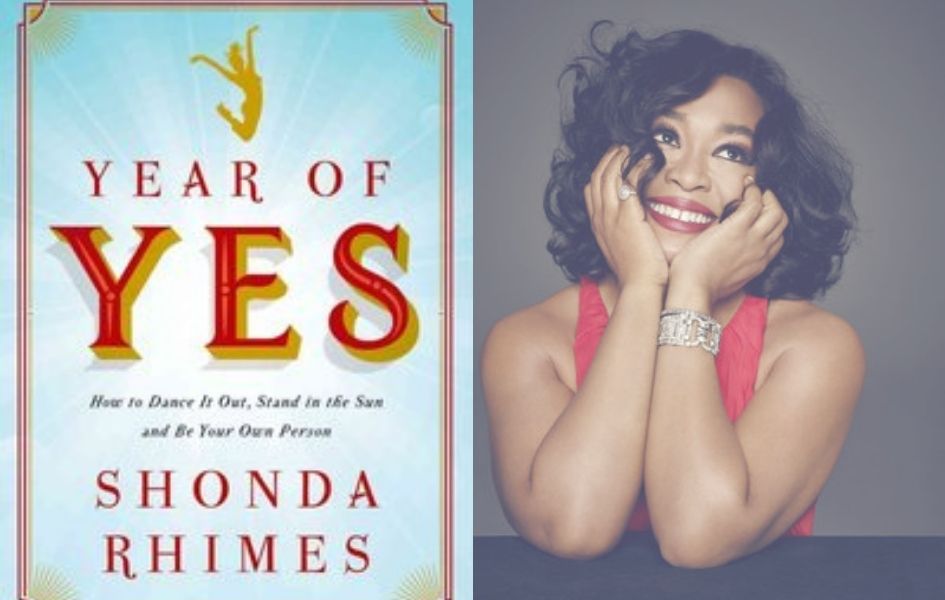

Year of Yes

Year of Yes - Add Value To Our Lives (this blog post contains an affiliate links which means I may receive a commission if you click a link and make a purchase. please read my disclosure for details) In 2016, I participated in a book club and we were asked to read...