A Budget Is A Powerfult Tool

Our Budget Tracker is a powerful tool designed to help you effortlessly track the inflow and outflow of your money.

Unlocking Financial Freedom: Small Steps Budget Kit

Are you ready to embark on a journey towards financial stability and wealth? Our Small Steps Budget Kit is here to empower you on your path to financial freedom.

Today, I will explore why a budget is a powerful tool to take control of your finances, as well as six ways a budget can help you build financial stability and create wealth.

1. Track Your Money

A budget is a visual representation of the inflow and outflow of your money. By tracking your income and expenses, you gain a clear understanding of where your money is going. This knowledge empowers you to make informed choices about your spending habits.

2. Set and Achieve Financial Goals

One of the most powerful aspects of budgeting is the ability to set and achieve financial goals. Whether it’s paying off debt, saving for a down payment, or building an emergency fund, a budget helps you allocate your resources intentionally. By aligning your spending with your financial goals, you’ll be amazed at how quickly you can turn your dreams into reality.

3. Reduce Financial Stress

Financial stress can weigh heavily on our well-being. By having a solid financial plan in place, you’ll experience reduced anxiety and uncertainty around money. With a budget, you’ll have a clearer picture of your financial situation.

4. Build An Emergency Fund

Life is full of unexpected surprises, and having an emergency fund is crucial for weathering those storms. A budget helps you allocate a portion of your income towards building an emergency fund. By consistently saving, you’ll create a financial safety net that protects you from unforeseen circumstances.

5. Pay Off Debt and Achieve Financial Freedom

Debt can be a heavy burden, holding you back from achieving your financial goals. By allocating extra funds towards debt repayment, you can accelerate your journey to becoming debt-free.

6. Grow Your Wealth

Building wealth is not just about earning money but also about how you manage it. A budget helps you prioritize saving and investing. By setting aside a portion of your income for investments, you can grow your wealth over time. A budget makes sure that you’re consistently moving towards building financial freedom.

Summary

Don’t underestimate the power of a budget in transforming your financial life.

Our Small Steps Budget Kit is the key to unlocking financial freedom and building wealth.

By tracking your money, setting goals, reducing stress, building an emergency fund, paying off debt, and investing wisely, you’ll be on your way to achieving financial stability.

Remember, it’s never too late to start taking control of your finances.

Start budgeting today and watch your financial future flourish!

Take the first step towards financial empowerment – Grab a copy of our Small Steps Budget Kit today!

Sherry Lou

DISCLOSURE: THIS POST MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS, AT NO COST TO YOU.

Live Your Best Life – Activate Your Vision

The time to activate my vision is now. It’s time to pursue the dream in my heart. For years, I’ve been talking about traveling to the east coast; but, something always seemed to interfere with my plans. Last fall, I decided to stop talking and take action. I set a...

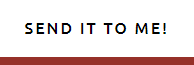

Becoming Financially Fit

My journey to becoming financially fit Most of my adult life I was not financially fit. My finances were so "out of shape". I had been plagued by high interest rate loans because of my low credit scores. And, those low credit scores were costing me more money over the...

Transform Your Life

Choose to Transform Your Life One Thought at a Time A few months ago, I wrote a blog post about goal setting and mental blocks. I hate to say this, but I’m still feeling stuck. I’ve been searching for ways to transform my life. Searching for ways that I can change...

2018 Goal Setting

Goal Setting and Mental Blocks For the past few weeks of 2017, I received so many emails regarding 2018 goal setting. 2017 - A Year in Review. Don’t get me wrong….i believe in the concept except I use my birthday (Nov) as the start of my new year. But, my birthday...

So what’s it all about

Welcome to SherryLouMiller.com I've spent quite a bit of time thinking about the content that I would like to post on my blog. And it all comes back to storytelling... But then I began to analyze the concept of storytelling. Would that limit the conversations...