Create A Small Steps Savings Plan

Creating a small steps savings plan can be an effective way to achieve your financial goals without feeling overwhelmed or discouraged. Here are some steps you can take to create a savings plan that works for you:

1. Define your financial goals

The first step in creating a savings plan is to define your financial goals. This could be anything from saving for a down payment on a house, to building an emergency fund, to investing for retirement. Once you’ve identified your goals, determine how much you need to save and by when.

Here are some tips on how to use The Spending Diary to meet your financial goals, align your spending with your values; and help change your money mindset and money story.

2. Break down your financial goals into smaller, achievable goals

Next, break down your financial goals into smaller, more manageable goals that you can work towards over time. For example, if your goal is to save $10,000 for a trip to Europe, you might aim to save $416.67 per month. This can be less overwhelming than focusing on meeting your $10,000 target amount.

3. Create a Budget

Creating a budget is a crucial step in any savings plan. Calculate your monthly income and expenses and identify areas where you can cut back to free up more money for savings. This might involve reducing spending, negotiating bills, or finding ways to increase your income.

4. Automate Your Savings

One of the most effective ways to save money is to include it as part of your budget. Pay yourself first. Set up automatic transfers from your checking account to a savings account. This will ensure that you’re consistently setting money aside towards your financial goals, even if you don’t have the time to do so manually.

5. Prioritize debt repayment

If you have outstanding debts, it’s important to create a repayment plan – prioritizing repayment. This might involve focusing on higher-interest debt first and/or consolidating multiple debts into a single payment to make the payment more manageable. By reducing your debt burden, you’ll be more motivated to save and you should have more money available for savings.

Stay on track

Share your financial goals with a friend and/or family member that you trust. This may provide some accountability and support. In addition, sharing your money goals can help you stay motivated and on track with your savings plan.

Summary

In conclusion, creating a small steps savings plan can be an effective way to achieve your financial goals. By defining your goals, breaking them down into smaller, achievable steps, creating a budget, automating your savings, prioritizing debt repayment, and seeking accountability and support, you can build momentum and achieve success over time. Remember, even small steps can lead to big results.

Check out some of my small steps savings plans. Start from where you are now. But, it’s important to get started!

Sherry Lou

DISCLOSURE: THIS POST MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS, AT NO COST TO YOU.

Credit Education Tips

Credit Education Tips Today, I'm joined by Kevin Butts and he's providing some awesome credit educations tips. Throughout the video, we'll touch on various aspects of the credit scoring model. Watch in its entirety Kevin provides a general/broad overview...

Money Mindset – Mindful Spending Plan

Create Financial Flexibility with Mindful Spending Habits Today, I'm going to talk about money mindset and creating mindful spending habits. When you desire change, the first step is awareness. So, before you do anything else, you'll need to assess your...

How to Use Canva Tutorial

How to use Canva tutorial In this video, I'm going to shares some tips on how I use Canva in my digital product business. I'll share features that keep me organized, as well as, different features that I use to design my digital products. Earning Additional Income...

How to Budget Money

How to Budget Money - Budget Spreadsheet Money comes in, money goes out. The question is….. do you know where it’s going? Whether the answer is yes or no, there's probably some room for improvement. Create a Budget Let’s create a spending plan to improve your finances...

Manifesting with Scripting vs traditional Vision Board

Scripting versus Traditional Vision Boards For years, I've been writing my dreams in a journal and creating a vision board. It wasn't until recently that I discovered this journaling process is known as Scripting. What is scripting? In case you aren't familiar with...

30 Day Gratitude Challenge

Take the 30-Day Gratitude Challenge November is officially National Gratitude Month, so what better time to participate in the 30 Days of Gratitude Challenge. The purpose of this challenge is to focus each day on someone in your life for who you feel appreciation....

What’s Your Latte Factor?

The Latte Factor? Do you know yours? Recently, I was listening to Lewis Howes’ podcast - Be Financially Free and Pay Yourself First with David Bach (episode 791). After listening to this episode, I decided to purchase the book (The Latte Factor) and create a two-part...

How to Build Online Sales Funnels – One Funnel Away (OFA) Review

How to Build Online Sales Funnels – One Funnel Away (OFA) Review THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR DETAILS My introduction to One Funnel Away 30-Day Challenge… A few months ago (March 2019), I signed up for Russell Brunson’s...

Boost Your Savings in 2019

5 Simple Challenges to Boost Your Savings in 2019 Whether you are participating in a challenge to boost your savings, starting a new project and/or setting life goals, it’s important that you start with a “self-trust mindset”. You must believe in yourself and know...

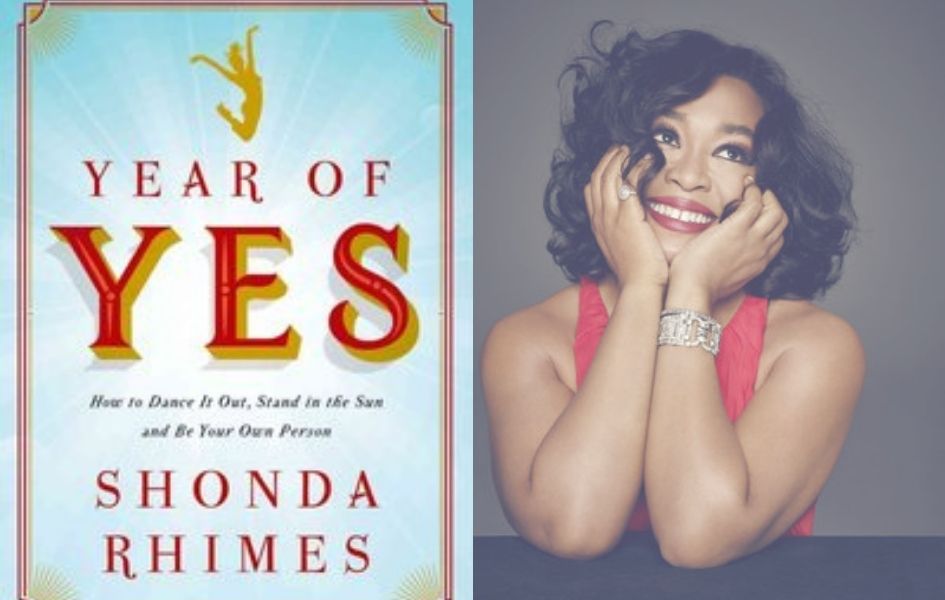

Year of Yes

Year of Yes - Add Value To Our Lives (this blog post contains an affiliate links which means I may receive a commission if you click a link and make a purchase. please read my disclosure for details) In 2016, I participated in a book club and we were asked to read...