Create A Small Steps Savings Plan

Creating a small steps savings plan can be an effective way to achieve your financial goals without feeling overwhelmed or discouraged. Here are some steps you can take to create a savings plan that works for you:

1. Define your financial goals

The first step in creating a savings plan is to define your financial goals. This could be anything from saving for a down payment on a house, to building an emergency fund, to investing for retirement. Once you’ve identified your goals, determine how much you need to save and by when.

Here are some tips on how to use The Spending Diary to meet your financial goals, align your spending with your values; and help change your money mindset and money story.

2. Break down your financial goals into smaller, achievable goals

Next, break down your financial goals into smaller, more manageable goals that you can work towards over time. For example, if your goal is to save $10,000 for a trip to Europe, you might aim to save $416.67 per month. This can be less overwhelming than focusing on meeting your $10,000 target amount.

3. Create a Budget

Creating a budget is a crucial step in any savings plan. Calculate your monthly income and expenses and identify areas where you can cut back to free up more money for savings. This might involve reducing spending, negotiating bills, or finding ways to increase your income.

4. Automate Your Savings

One of the most effective ways to save money is to include it as part of your budget. Pay yourself first. Set up automatic transfers from your checking account to a savings account. This will ensure that you’re consistently setting money aside towards your financial goals, even if you don’t have the time to do so manually.

5. Prioritize debt repayment

If you have outstanding debts, it’s important to create a repayment plan – prioritizing repayment. This might involve focusing on higher-interest debt first and/or consolidating multiple debts into a single payment to make the payment more manageable. By reducing your debt burden, you’ll be more motivated to save and you should have more money available for savings.

Stay on track

Share your financial goals with a friend and/or family member that you trust. This may provide some accountability and support. In addition, sharing your money goals can help you stay motivated and on track with your savings plan.

Summary

In conclusion, creating a small steps savings plan can be an effective way to achieve your financial goals. By defining your goals, breaking them down into smaller, achievable steps, creating a budget, automating your savings, prioritizing debt repayment, and seeking accountability and support, you can build momentum and achieve success over time. Remember, even small steps can lead to big results.

Check out some of my small steps savings plans. Start from where you are now. But, it’s important to get started!

Sherry Lou

DISCLOSURE: THIS POST MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS, AT NO COST TO YOU.

Live Your Best Life – Activate Your Vision

The time to activate my vision is now. It’s time to pursue the dream in my heart. For years, I’ve been talking about traveling to the east coast; but, something always seemed to interfere with my plans. Last fall, I decided to stop talking and take action. I set a...

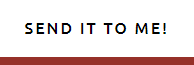

Becoming Financially Fit

My journey to becoming financially fit Most of my adult life I was not financially fit. My finances were so "out of shape". I had been plagued by high interest rate loans because of my low credit scores. And, those low credit scores were costing me more money over the...

Transform Your Life

Choose to Transform Your Life One Thought at a Time A few months ago, I wrote a blog post about goal setting and mental blocks. I hate to say this, but I’m still feeling stuck. I’ve been searching for ways to transform my life. Searching for ways that I can change...

2018 Goal Setting

Goal Setting and Mental Blocks For the past few weeks of 2017, I received so many emails regarding 2018 goal setting. 2017 - A Year in Review. Don’t get me wrong….i believe in the concept except I use my birthday (Nov) as the start of my new year. But, my birthday...

So what’s it all about

Welcome to SherryLouMiller.com I've spent quite a bit of time thinking about the content that I would like to post on my blog. And it all comes back to storytelling... But then I began to analyze the concept of storytelling. Would that limit the conversations...