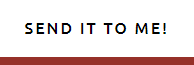

Unlocking Financial Freedom: The Power of the Debt Snowball Method

Facing Financial Challenges

In today’s fast-paced world, many people, especially beginner budgeters, find themselves facing overwhelming debt and financial stress. The constant struggle to keep up with monthly payments can feel like an uphill battle, leaving many feeling discouraged and uncertain about their financial future. However, amidst these challenges, there is hope.

Discovering a Path to Financial Freedom

The Debt Snowball Method

Enter the Debt Snowball Method, a debt repayment plan that offers a clear path to financial freedom. This method empowers you to take control of your finances, break free from debt, and pave the way to a brighter financial future, even for those just starting out on their budgeting journey.

Starting Small: The Key to Success

Beginning with the Smallest Debt

One of the key principles of the Debt Snowball Method is starting small. Rather than focusing on the overwhelming total amount of debt, this method encourages you to tackle the smallest debt first. By doing so, you can experience quick wins and build momentum, creating a snowball effect that propels you towards larger debt repayments.

Benefits of Creating a Debt Reduction Plan

Clarity, Discipline, and Empowerment

Creating a debt reduction plan brings numerous benefits. It provides clarity and direction, helping you understand your financial situation and set achievable goals. Additionally, it instills discipline and accountability, as you commit to making regular payments towards your debts. Most importantly, it empowers you to take control of your finances, reducing stress and anxiety and providing peace of mind.

Finding Additional Monthly Payments

Reviewing Budgets and Increasing Income

Finding additional monthly payments to allocate towards debt repayment may seem daunting, but it’s achievable. By reviewing budgets and identifying areas where expenses can be reduced, you can free up extra funds for debt repayment. Additionally, exploring opportunities to increase income, such as part-time work or freelancing, can provide additional resources to put towards debt repayment.

Utilizing the 12-Week Sprint

A Structured Framework for Success

The 12-Week Sprint Debt Repayment eBook offers a structured framework for reducing debt and building financial flexibility. Each week, you will focus on specific aspects of debt repayment, from assessing your financial situation to implementing strategies for staying on track. By breaking the process down into manageable steps and committing to the plan for 12 weeks, you can set yourself up for success and create momentum towards your goals.

Grab a copy of our free eBook – Steady Incremental Progress today!

Creating Financial Flexibility

Assessing Income and Expenses

Financial flexibility is essential for maintaining stability and progress towards debt repayment. By assessing income and expenses, you can identify areas where spending can be reduced or income can be increased to free up extra funds for debt repayment. Additionally, setting up a separate savings account for emergencies ensures a safety net is in place while focusing on debt reduction.

Conclusion: Embracing the Journey to Financial Freedom

The Debt Snowball Method offers a powerful strategy for breaking free from debt and achieving financial freedom, even for beginner budgeters.

By starting small, creating a debt reduction plan, finding additional monthly payments, utilizing the 12-Week Sprint eBook, and creating financial flexibility, you can lower your debt, gain control of your finances, and pave the way to a brighter financial future.

Every step taken towards debt repayment brings you closer to your goals. With determination and perseverance, you can embrace your journey to financial freedom and secure a brighter future for yourself.

Take the first step towards financial empowerment.

Sherry Lou

DISCLOSURE: THIS POST MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS, AT NO COST TO YOU.

Disclaimer:

The information provided in this blog post is for educational purposes only and should not be construed as financial advice. While we strive to provide accurate and up-to-date information, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the content contained herein. Any reliance you place on such information is therefore strictly at your own risk.

We are not financial advisors, and this blog post does not constitute financial advice. Before making any financial decisions or implementing any debt repayment strategies, we strongly recommend consulting with a qualified financial advisor who can assess your individual financial situation and provide personalized guidance tailored to your needs and goals.

In addition, any references to specific debt repayment methods, budgeting techniques, or financial products are provided for illustrative purposes only and do not imply endorsement or recommendation. Individual results may vary, and there is no guarantee that following the strategies outlined in this blog post will lead to financial success or debt freedom.

By reading this blog post, you acknowledge and agree that we shall not be liable for any loss or damage arising from your reliance on the information presented herein. You are solely responsible for your financial decisions, and we encourage you to conduct thorough research and seek professional advice before taking any action related to your finances.

Credit Education Tips

Credit Education Tips Today, I'm joined by Kevin Butts and he's providing some awesome credit educations tips. Throughout the video, we'll touch on various aspects of the credit scoring model. Watch in its entirety Kevin provides a general/broad overview...

Money Mindset – Mindful Spending Plan

Create Financial Flexibility with Mindful Spending Habits Today, I'm going to talk about money mindset and creating mindful spending habits. When you desire change, the first step is awareness. So, before you do anything else, you'll need to assess your...

How to Use Canva Tutorial

How to use Canva tutorial In this video, I'm going to shares some tips on how I use Canva in my digital product business. I'll share features that keep me organized, as well as, different features that I use to design my digital products. Earning Additional Income...

How to Budget Money

How to Budget Money - Budget Spreadsheet Money comes in, money goes out. The question is….. do you know where it’s going? Whether the answer is yes or no, there's probably some room for improvement. Create a Budget Let’s create a spending plan to improve your finances...

Manifesting with Scripting vs traditional Vision Board

Scripting versus Traditional Vision Boards For years, I've been writing my dreams in a journal and creating a vision board. It wasn't until recently that I discovered this journaling process is known as Scripting. What is scripting? In case you aren't familiar with...

30 Day Gratitude Challenge

Take the 30-Day Gratitude Challenge November is officially National Gratitude Month, so what better time to participate in the 30 Days of Gratitude Challenge. The purpose of this challenge is to focus each day on someone in your life for who you feel appreciation....

What’s Your Latte Factor?

The Latte Factor? Do you know yours? Recently, I was listening to Lewis Howes’ podcast - Be Financially Free and Pay Yourself First with David Bach (episode 791). After listening to this episode, I decided to purchase the book (The Latte Factor) and create a two-part...

How to Build Online Sales Funnels – One Funnel Away (OFA) Review

How to Build Online Sales Funnels – One Funnel Away (OFA) Review THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR DETAILS My introduction to One Funnel Away 30-Day Challenge… A few months ago (March 2019), I signed up for Russell Brunson’s...

Boost Your Savings in 2019

5 Simple Challenges to Boost Your Savings in 2019 Whether you are participating in a challenge to boost your savings, starting a new project and/or setting life goals, it’s important that you start with a “self-trust mindset”. You must believe in yourself and know...

Year of Yes

Year of Yes - Add Value To Our Lives (this blog post contains an affiliate links which means I may receive a commission if you click a link and make a purchase. please read my disclosure for details) In 2016, I participated in a book club and we were asked to read...