Unlocking Financial Freedom: The Power of the Debt Snowball Method

Facing Financial Challenges

In today’s fast-paced world, many people, especially beginner budgeters, find themselves facing overwhelming debt and financial stress. The constant struggle to keep up with monthly payments can feel like an uphill battle, leaving many feeling discouraged and uncertain about their financial future. However, amidst these challenges, there is hope.

Discovering a Path to Financial Freedom

The Debt Snowball Method

Enter the Debt Snowball Method, a debt repayment plan that offers a clear path to financial freedom. This method empowers you to take control of your finances, break free from debt, and pave the way to a brighter financial future, even for those just starting out on their budgeting journey.

Starting Small: The Key to Success

Beginning with the Smallest Debt

One of the key principles of the Debt Snowball Method is starting small. Rather than focusing on the overwhelming total amount of debt, this method encourages you to tackle the smallest debt first. By doing so, you can experience quick wins and build momentum, creating a snowball effect that propels you towards larger debt repayments.

Benefits of Creating a Debt Reduction Plan

Clarity, Discipline, and Empowerment

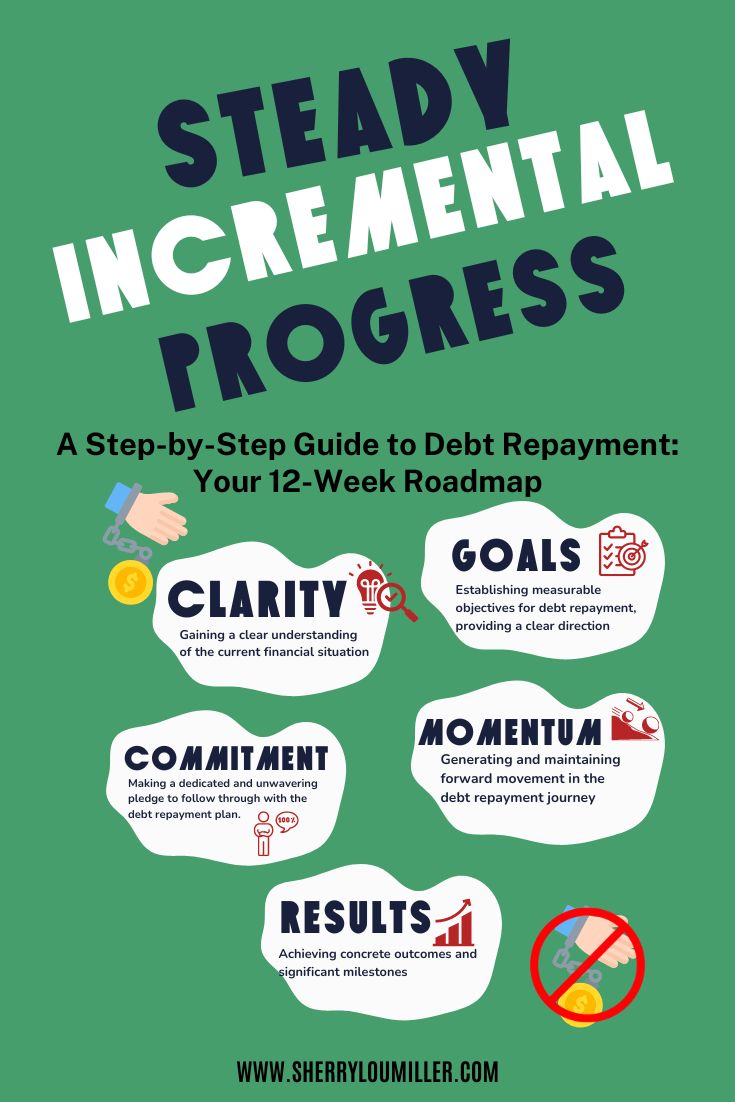

Creating a debt reduction plan brings numerous benefits. It provides clarity and direction, helping you understand your financial situation and set achievable goals. Additionally, it instills discipline and accountability, as you commit to making regular payments towards your debts. Most importantly, it empowers you to take control of your finances, reducing stress and anxiety and providing peace of mind.

Finding Additional Monthly Payments

Reviewing Budgets and Increasing Income

Finding additional monthly payments to allocate towards debt repayment may seem daunting, but it’s achievable. By reviewing budgets and identifying areas where expenses can be reduced, you can free up extra funds for debt repayment. Additionally, exploring opportunities to increase income, such as part-time work or freelancing, can provide additional resources to put towards debt repayment.

Utilizing the 12-Week Sprint

A Structured Framework for Success

The 12-Week Sprint Debt Repayment eBook offers a structured framework for reducing debt and building financial flexibility. Each week, you will focus on specific aspects of debt repayment, from assessing your financial situation to implementing strategies for staying on track. By breaking the process down into manageable steps and committing to the plan for 12 weeks, you can set yourself up for success and create momentum towards your goals.

Grab a copy of our free eBook – Steady Incremental Progress today!

Creating Financial Flexibility

Assessing Income and Expenses

Financial flexibility is essential for maintaining stability and progress towards debt repayment. By assessing income and expenses, you can identify areas where spending can be reduced or income can be increased to free up extra funds for debt repayment. Additionally, setting up a separate savings account for emergencies ensures a safety net is in place while focusing on debt reduction.

Conclusion: Embracing the Journey to Financial Freedom

The Debt Snowball Method offers a powerful strategy for breaking free from debt and achieving financial freedom, even for beginner budgeters.

By starting small, creating a debt reduction plan, finding additional monthly payments, utilizing the 12-Week Sprint eBook, and creating financial flexibility, you can lower your debt, gain control of your finances, and pave the way to a brighter financial future.

Every step taken towards debt repayment brings you closer to your goals. With determination and perseverance, you can embrace your journey to financial freedom and secure a brighter future for yourself.

Take the first step towards financial empowerment.

Sherry Lou

DISCLOSURE: THIS POST MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS, AT NO COST TO YOU.

Disclaimer:

The information provided in this blog post is for educational purposes only and should not be construed as financial advice. While we strive to provide accurate and up-to-date information, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the content contained herein. Any reliance you place on such information is therefore strictly at your own risk.

We are not financial advisors, and this blog post does not constitute financial advice. Before making any financial decisions or implementing any debt repayment strategies, we strongly recommend consulting with a qualified financial advisor who can assess your individual financial situation and provide personalized guidance tailored to your needs and goals.

In addition, any references to specific debt repayment methods, budgeting techniques, or financial products are provided for illustrative purposes only and do not imply endorsement or recommendation. Individual results may vary, and there is no guarantee that following the strategies outlined in this blog post will lead to financial success or debt freedom.

By reading this blog post, you acknowledge and agree that we shall not be liable for any loss or damage arising from your reliance on the information presented herein. You are solely responsible for your financial decisions, and we encourage you to conduct thorough research and seek professional advice before taking any action related to your finances.

Live Your Best Life – Activate Your Vision

The time to activate my vision is now. It’s time to pursue the dream in my heart. For years, I’ve been talking about traveling to the east coast; but, something always seemed to interfere with my plans. Last fall, I decided to stop talking and take action. I set a...

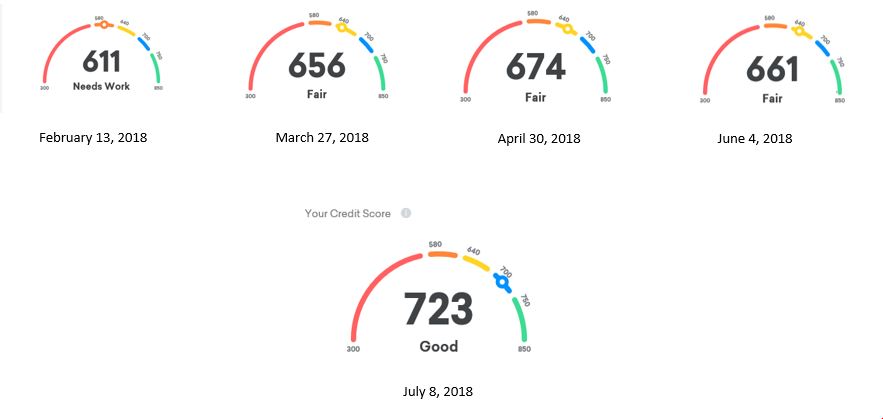

Becoming Financially Fit

My journey to becoming financially fit Most of my adult life I was not financially fit. My finances were so "out of shape". I had been plagued by high interest rate loans because of my low credit scores. And, those low credit scores were costing me more money over the...

Transform Your Life

Choose to Transform Your Life One Thought at a Time A few months ago, I wrote a blog post about goal setting and mental blocks. I hate to say this, but I’m still feeling stuck. I’ve been searching for ways to transform my life. Searching for ways that I can change...

2018 Goal Setting

Goal Setting and Mental Blocks For the past few weeks of 2017, I received so many emails regarding 2018 goal setting. 2017 - A Year in Review. Don’t get me wrong….i believe in the concept except I use my birthday (Nov) as the start of my new year. But, my birthday...

So what’s it all about

Welcome to SherryLouMiller.com I've spent quite a bit of time thinking about the content that I would like to post on my blog. And it all comes back to storytelling... But then I began to analyze the concept of storytelling. Would that limit the conversations...