Track Your Spending Habits

Money is and will always be an essential part of our life. Sometimes it may feel overwhelming to manage your money; but one way you can change your money mindset is by tracking your spending habits.

Keep a Spending Diary

Keeping a spending diary is one of the most effective ways to track your expenses, stay on top of your finances, and achieve your financial goals. By documenting your spending habits, you can see where your money is going, identify areas where you may be overspending and/or underspending, and adjust as needed.

Here are some tips on how to use The Spending Diary to meet your financial goals, align your spending with your values; and help change your money mindset and money story.

#1 Start by tracking your spending habits daily

To change your money mindset, you need to know where your money is going. The first step is to track your spending habits.

For 31 days track all your daily spending. You can use The Spending Diary bundle to track your expenses.

#2 Categorize Your Expenses

Once you have tracked your daily spending habits, the 24/7 spending spreadsheet will categorize them into different budget categories such as housing, transportation, food, entertainment, and so on. This will help you identify areas where you may be overspending or underspending.

#3 Analyze Your Spending Habits

Review your spending habits over this 31-day period. Analyze where you are spending the most money and identify areas where you can make changes. For example, if you are spending too much money on eating out, you can cut back on that expense by cooking at home more often.

#4 Set Financial Goals

Setting financial goals can help you change your money mindset. It gives you a sense of direction and it can motivate you to save more money.

Start by setting small goals, such as saving $25-50 a month, then gradually increase your goals over time as you become more comfortable with managing your money.

#5 Create a Budget

Creating a budget is an important part of changing your money mindset. It allows you to plan your expenses and save money for the things that are important to you.

Use the information you collected from tracking your spending habits to create a budget that works for your lifestyle. Remember, a budget isn’t meant to deprive you of the things that you want in life. A budget provides direction for your money. It is a visual representation of where your money is going.

Summary

In conclusion, one of the key ways to create better financial habits is by improving our money mindset. A positive money mindset involves a healthy attitude towards money and an understanding of the importance of saving and spending.

Changing your money mindset doesn’t need to be challenging, but it should be a rewarding experience. The Spending Diary is a powerful tool that can help you identify areas where you can make changes and improve your overall financial well-being.

By setting financial goals, creating a budget, and analyzing your spending habits, you can develop a positive money mindset and take control of your finances.

Sherry Lou

DISCLOSURE: THIS POST MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS, AT NO COST TO YOU.

Live Your Best Life – Activate Your Vision

The time to activate my vision is now. It’s time to pursue the dream in my heart. For years, I’ve been talking about traveling to the east coast; but, something always seemed to interfere with my plans. Last fall, I decided to stop talking and take action. I set a...

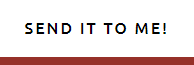

Becoming Financially Fit

My journey to becoming financially fit Most of my adult life I was not financially fit. My finances were so "out of shape". I had been plagued by high interest rate loans because of my low credit scores. And, those low credit scores were costing me more money over the...

Transform Your Life

Choose to Transform Your Life One Thought at a Time A few months ago, I wrote a blog post about goal setting and mental blocks. I hate to say this, but I’m still feeling stuck. I’ve been searching for ways to transform my life. Searching for ways that I can change...

2018 Goal Setting

Goal Setting and Mental Blocks For the past few weeks of 2017, I received so many emails regarding 2018 goal setting. 2017 - A Year in Review. Don’t get me wrong….i believe in the concept except I use my birthday (Nov) as the start of my new year. But, my birthday...

So what’s it all about

Welcome to SherryLouMiller.com I've spent quite a bit of time thinking about the content that I would like to post on my blog. And it all comes back to storytelling... But then I began to analyze the concept of storytelling. Would that limit the conversations...